HMRC begin mailing taxi drivers and self-employed workers who may fall into new Making Tax Digital rules

- Perry Richardson

- Jun 4, 2025

- 3 min read

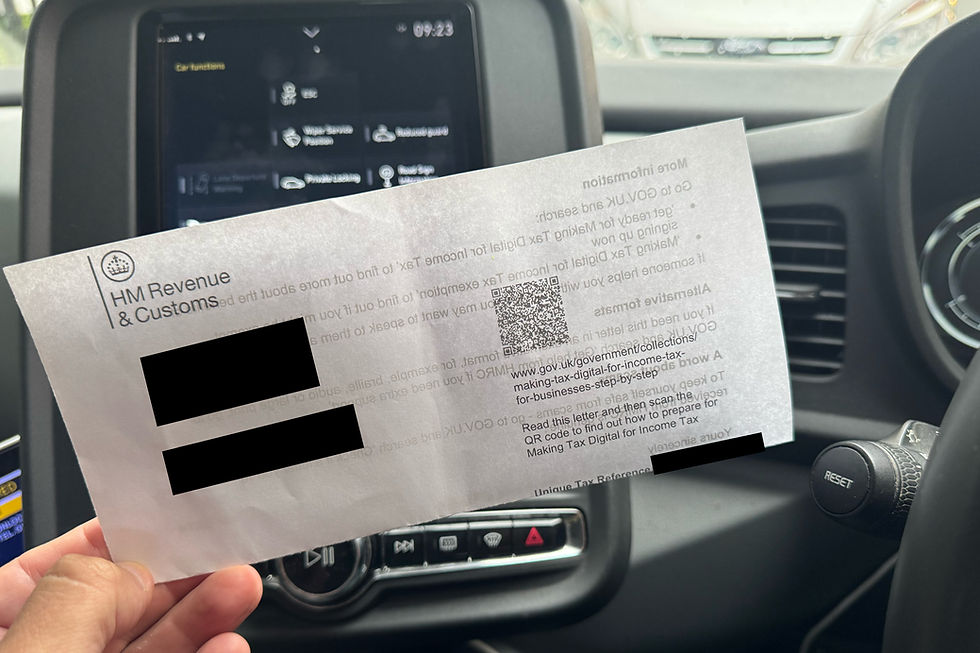

HM Revenue and Customs (HMRC) have begun sending out letters to taxi drivers and other self-employed workers that may fall into new Making Tax Digital (MTD).

Self-employed taxi drivers earning over £50,000 annually will be among the first in the trade to be affected by new digital tax reporting rules set to start from 6 April 2026 and would have received a May issued letter from HMRC warning them. The changes are part of the Government’s wider MTD for Income Tax programme, which aims to modernise the way income is reported to HMRC.

From that date, qualifying self-employed drivers will need to keep digital records and send quarterly updates of income and expenses using MTD-compatible software. This marks a major shift in how self-employed earnings are recorded and reported, moving away from the once-a-year self-assessment model many in the taxi trade have used for decades.

Impact on the taxi trade

For the taxi trade, these changes will have wide-ranging consequences. Drivers must now consider how they keep financial records, with digital tools becoming essential. This may push older or less digitally confident drivers to reassess their position in the industry. There are concerns that those who have worked in the trade for many years but are not confident with apps, cloud systems or online portals could feel pressured to leave rather than adapt.

Some taxi operators have already noted that drivers often prefer paper-based systems or manually summarise their income ahead of the tax deadline. The move to quarterly reporting will likely disrupt these habits and require new approaches. Those without smartphones or regular access to computers could find the process particularly challenging, even with support available.

Increased need for income documentation from operators and card providers

The new system will also place greater emphasis on accurate and timely data. Self-employed taxi drivers often rely on a combination of operator shift records, cash income, and digital payment takings. To meet quarterly deadlines, drivers will likely need more frequent and reliable statements of earnings from taxi operators and card payment solution providers.

Currently, some operators issue weekly or monthly statements, while others provide only end-of-year summaries. That will no longer be sufficient. Cabbies may need to request or demand more regular reporting from these sources to ensure their digital submissions are accurate and complete. This could place new pressures on operators and payment providers to improve the quality and accessibility of their reporting systems.

Preparing for the change

Around 780,000 self-employed individuals and landlords will be brought into MTD for Income Tax from April 2026. A further 970,000 will follow from April 2027 when the threshold lowers to £30,000. By April 2028, those earning more than £20,000 will also be included. Many more taxi drivers will therefore be affected over the next three years.

HMRC is encouraging drivers and their accountants to sign up for early testing through GOV.UK. There are no penalties for mistakes during this phase, which gives cabbies a chance to try the system in practice before it becomes mandatory.

The transition will take time and effort. But with the right preparation, it could also bring benefits—such as reduced errors, better financial oversight, and more predictable tax bills. For now, the key for taxi drivers is to act early, understand what’s changing, and begin adjusting how they manage their finances before the deadline arrives.