Unemployed people and taxi drivers face higher car insurance premiums uncovers new analysis

- Perry Richardson

- Oct 22, 2020

- 2 min read

People who are unemployed or work as taxi drivers face significantly higher car insurance premiums because of their job or employment status, according to new analysis by comparethemarket.com.

A policy for someone who is unemployed was 40% higher than a comparative policy for an employed person, or 54% higher than an HGV driver which is the cheapest profession for car insurance.

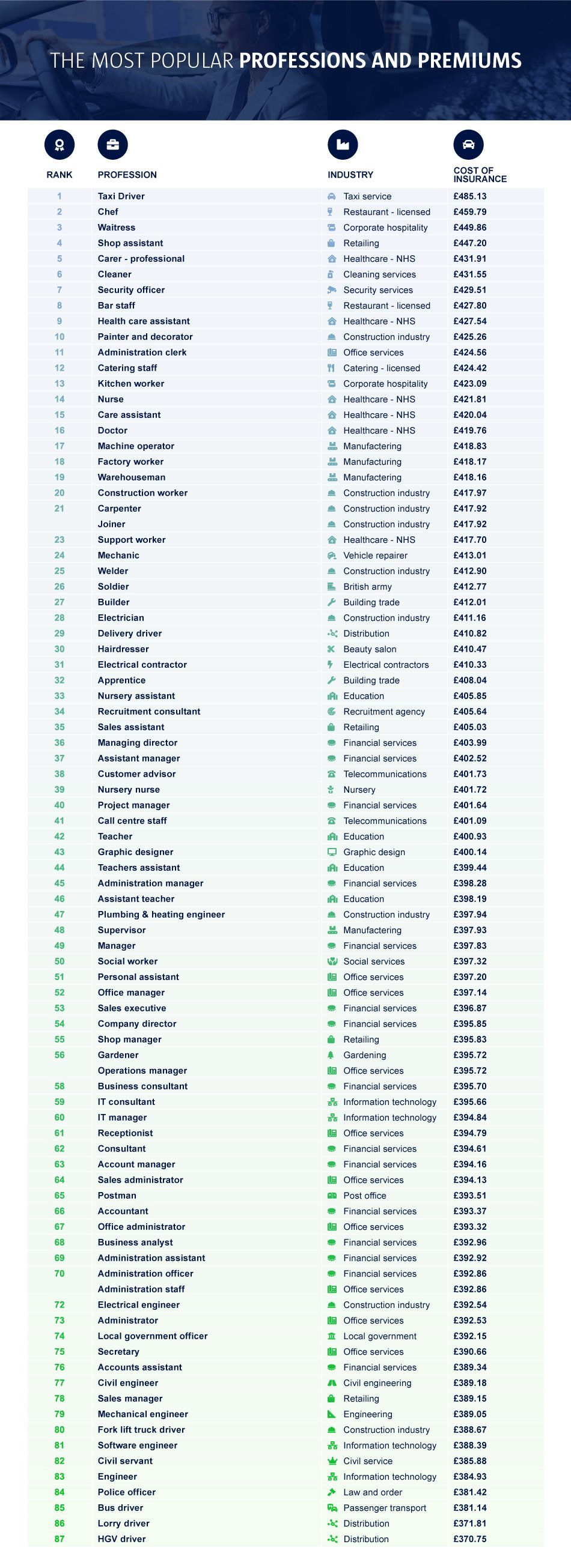

According to the research, cabbies face the highest premiums of those in work with an average policy totalling over £485. Compared to a HGV driver who pays on average £370 the policies based on job title alone represents a difference of over 30%.

The new research analysed car insurance quotes for almost 100 professions, based on a 30-year old man from Bury St Edmunds driving a Ford Fiesta, and included a consistent set of criteria while only changing the job title and industry. The research found that policies can be up to £200 more expensive depending on your job or employment status.

The analysis also found that some ‘key worker’ professions carry some of the highest car insurance premiums. For example, the cost of a policy for a carer stood at £431, 6% higher than the average, while a healthcare assistant for the NHS paid £427 for their policy, nearly 5% higher than the average. Some of the most expensive professions for car insurance include taxi drivers and chefs, whose premiums can cost £485 and £459 respectively.

For some, their profession could save them a significant amount of money on car insurance. The cheapest professions for car insurance are predominantly areas which involve a large proportion of driving. The top three cheapest are HGV, lorry and bus drivers who would pay between £370 and £381 for a policy.

Dan Hutson, Head of Motor Insurance at comparethemarket.com, said: “Premiums are calculated using a wide range of factors with some being used as a proxy for how likely that driver is to make a claim. Each factor has a different level of importance in an overall policy and this research demonstrates just how important a job title or employment status is when getting insurance. Take care that the information you disclose regarding your occupation and throughout the quote is accurate and complete to the best of your knowledge. If you don't do this, an insurance provider could increase your premium, cancel your policy, treat it as if it never existed, refuse a claim or not pay the claim in full.

“With millions expected to be made unemployed around the UK as a result of the pandemic, this research indicates that these individuals may face the increased financial burden of higher car insurance costs at a time when they can least afford it. If driving is unaffordable for this group, this could have a serious impact on their ability to secure another job, with our research showing that 54% of young drivers saying that not being able to afford to run their car will negatively impact their ability to get a job.”